The Most Overlooked Tax Break for Arizona Married Couples

“Most Arizona Couples (and Their CPAs) Miss This Simple Move That Could Save Thousands in Taxes”

Arizona Couples Are Losing Thousands in Taxes — Because Their CPAs Never Mention CPWROS. Just what is CPWROS?

In Arizona, Community Property with Right of Survivorship (CPWROS) is a legal arrangement for married couples to own assets, where both spouses own the property equally, and the surviving spouse automatically inherits the deceased spouse's interest without going through probate. CPWROS also provides a significant income tax benefit, allowing for a full step-up in the tax basis of the entire property to its fair market value at the time of the first spouse's death, which can result in lower capital gains taxes if the property is sold later.

How the step-up in basis works

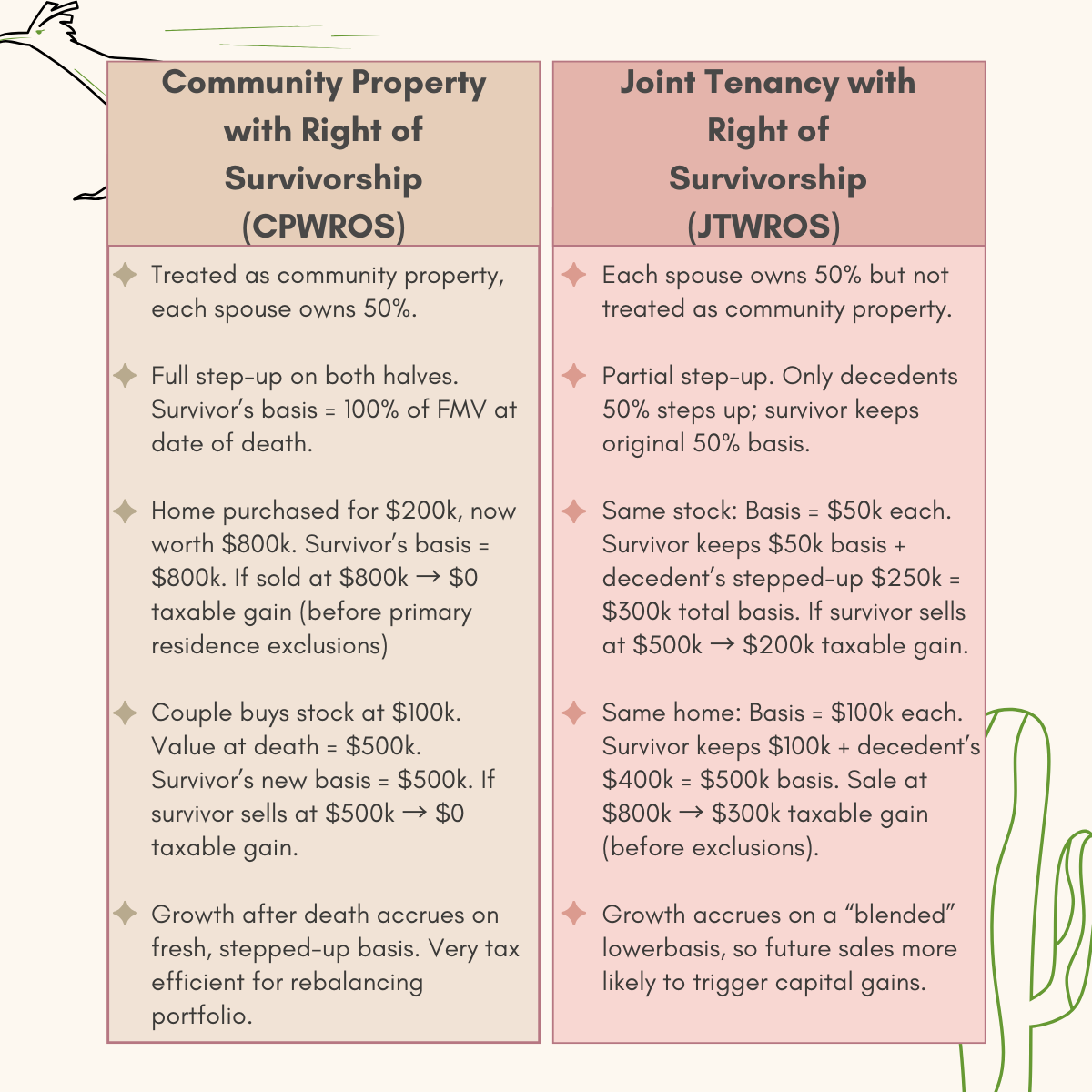

Without CPWROS (like with joint tenancy): Only the deceased spouse's half of the property receives a step-up in basis to the current fair market value. The surviving spouse's half retains the original, lower cost basis. If the property is then sold, the surviving spouse could face a substantial capital gains tax bill on their half of the property.

With CPWROS (the "double step-up"): In a community property state like Arizona, federal tax law provides a major tax advantage. When the first spouse dies, the basis of the entire property—both the deceased's and the survivor's halves—is "stepped up" to the fair market value at the time of death. This effectively erases any capital gains that occurred during the marriage.

How CPWROS Works and its Income Tax Benefit

Equal Ownership: Both spouses hold an equal, undivided interest in the property.

Automatic Transfer: Upon the death of one spouse, the property automatically passes to the surviving spouse.

Avoids Probate: This automatic transfer means the property does not have to go through the court-supervised probate process.

4. Reduced Capital Gains Tax: At the death of the first spouse, both halves of the property (the decedents and the survivor’s) generally receive a full step-up in basis to fair market value at date of death. When the surviving spouse later sells the property, any capital gains will be calculated based on the new, higher basis, significantly reducing the potential capital gains tax liability.

An Easy Guide to Comparing CPWROS to JTWROS: